Charging in Sync: Coordinating EV Infrastructure in Multifamily Housing for Equitable Electrification

As EV adoption grows, uncoordinated charging in multifamily housing risks higher costs, grid strain, and inequitable access. This article makes the case for a coordinated EV Ready strategy, highlighting how proactive planning, smart load management, and utility-aligned incentives can lower costs and deliver greater long-term value for ratepayers.

Despite potential policy headwinds, electric vehicle (EV) adoption in North America will continue to accelerate, driven particularly by declining battery prices and global market shifts.[1] Yet the ability to charge at home, the most convenient and affordable option, remains deeply unequal. In particular, multifamily housing residents face a shortage of charging infrastructure and unclear rules around who is responsible for installing chargers, and how those costs are shared.

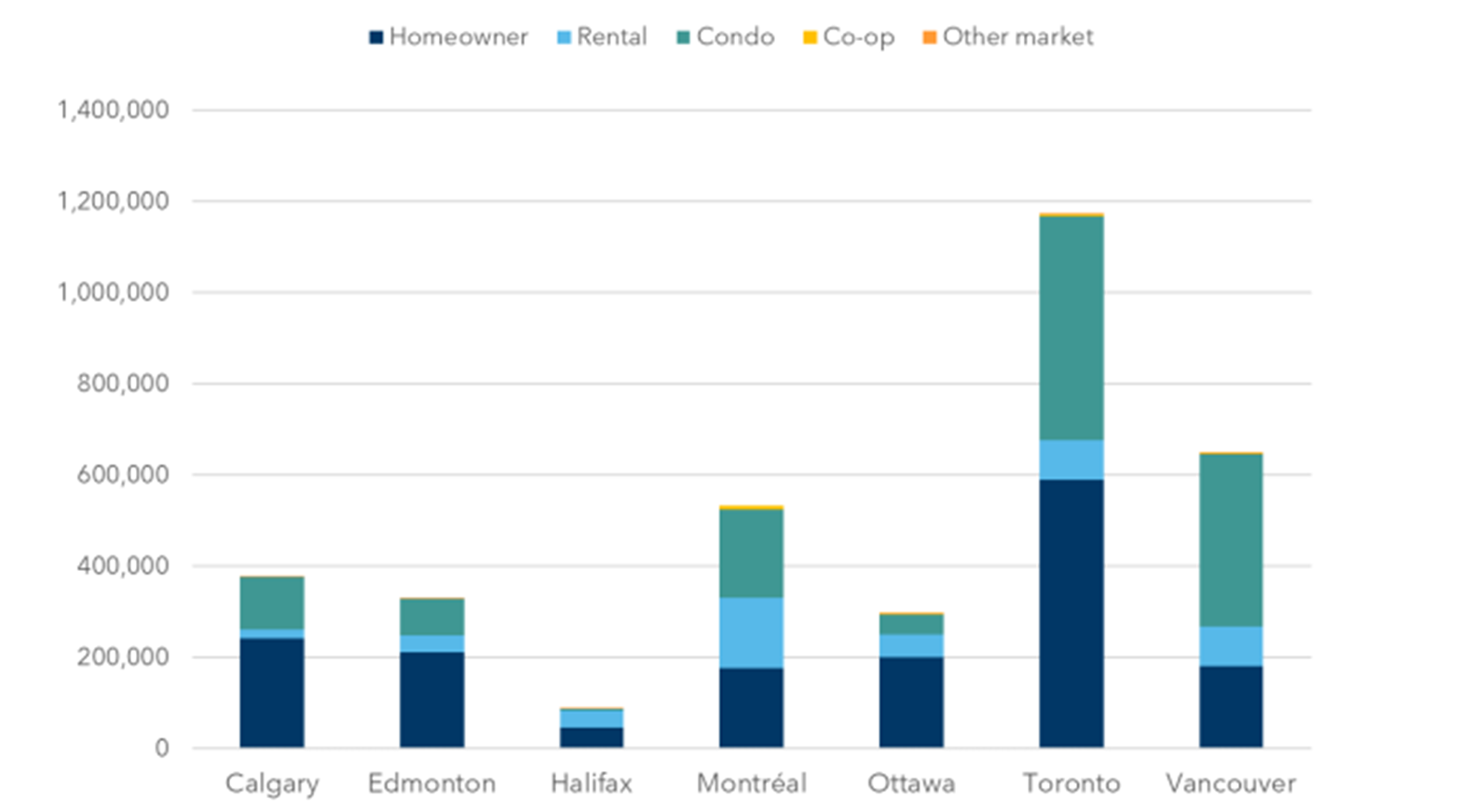

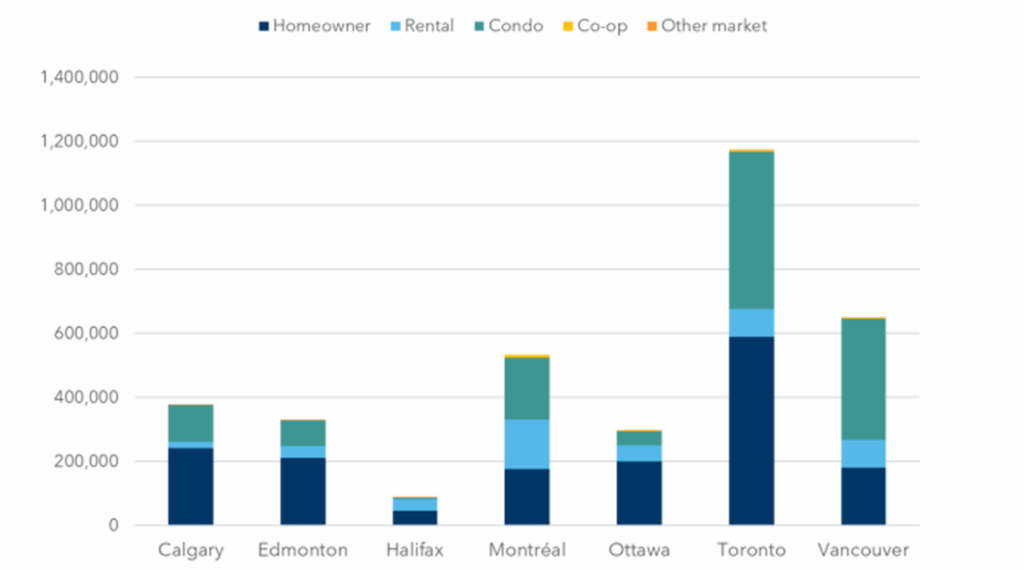

Figure 1: Housing Starts by Market Type and Census Metropolitan Area, 1988-2023

About one-third of housing units in North America (US + Canada) are multifamily buildings; this share reaches nearly half in many urban centres and is increasing as cities densify. Most multifamily buildings in Canadian metro areas are condos, though a sizeable stock of rental apartments, co-ops, and other building types also exist. But unlike single-family homeowners, multifamily housing residents often lack a driveway, a garage, or control over their building’s electrical infrastructure.

The result? A mounting electrification gap. Without proactive planning, these buildings will become bottlenecks in the clean transportation transition, creating grid strain, inequitable access, and rising retrofit costs. Fortunately, the same complexity that makes multifamily buildings challenging makes them uniquely valuable. With the right strategy, multifamily buildings can be transformed into hubs of cost-effective, grid-friendly electrification.

Unplanned Charging Retrofits Drive Up Costs and Inequity

Today, most EV charger installations in multifamily housing are reactive and uncoordinated. A multifamily building owner typically contacts an electrical contractor, who determines how to source power for a few EV charger installations. Contractors rarely consider how to optimize subsequent installations without explicit direction. Over time, this approach leads to duplicated panel upgrades, repeated trenching, and inconsistent technology choices.

The consequences compound:

- Per-stall installation costs increase significantly, especially as early installations exhaust available electrical capacity.

- Building-wide electrical upgrades become unavoidable, but are often implemented too late, resulting in higher costs.

- Stranded assets emerge when new installations are incompatible with older ones.

- Perhaps most critically, the grid absorbs unmanaged loads, increasing peak demand as local transformers near their capacity limits.

Beyond infrastructure and cost, there’s an equity dimension. Early adopters, often higher-income residents, secure access while it’s still easy. Later adopters, including renters and lower-income owners, face capacity limits, rising costs, or resistance from building residents. The result is a two-tier electrification system: one for those who move early, and one for those left behind.

How Futureproofing Lowers Costs and Grid Strain

Instead of retrofitting one charger at a time, a coordinated “EV Ready” strategy installs the foundational electrical infrastructure, conduits, panel capacity, and intelligent load management systems building-wide so that every space can be electrified over time without costly rewiring.

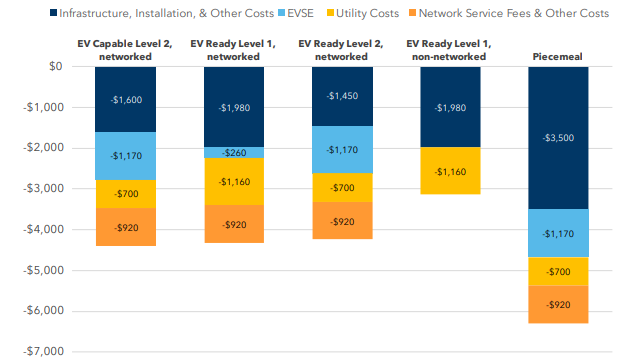

This future-proofing model is not only more equitable; it’s also more cost-effective. Studies show that fully EV Ready retrofits can reduce per-stall infrastructure costs by up to 55% compared to piecemeal installations. In addition to the lower costs for the building owner, this approach creates savings for the grid.[2] Central to this approach is the EV Energy Management System (EVEMS), which allows multiple chargers to share one circuit while managing real-time load. An EVEMS can enable four or more vehicles to safely charge using the capacity needed for just one.

Figure 2: Net present cost of different futureproofing configurations per parking space (7% discount rate on future cashflows)

Furthermore, comprehensive futureproofing strategies can generate meaningful ratepayer benefits, positioning EV Ready infrastructure as a utility-aligned investment rather than a customer-side cost. Specifically:

- Accelerated EV adoption: More residents are likely to switch to EVs when at-home charging is convenient and cost-effective. This can drive increased electricity sales, helping to spread fixed system costs across more kilowatt-hours, ultimately reducing per-unit rates for all customers.

- Lower peak impacts through smart design: Comprehensive EV Ready retrofits that use EVEMS enable multiple vehicles to share a single circuit by allocating charging power dynamically across connected EVs. Instead of all vehicles charging at full power simultaneously, EVEMS staggers or modulates charging, assigning different percentages of available capacity to each vehicle based on need, timing, or grid signals. This avoids coincident peak loads and flattens overall demand, reducing strain on local transformers and upstream grid infrastructure.

- Grid-aligned charging behavior: The EVEMS platforms that manage building-level loads can also be configured to respond to utility demand response signals. This enables EV charging to shift away from periods of peak wholesale costs or grid congestion, reducing the need for costly upstream infrastructure upgrades and enhancing system reliability.

From Cost to Value: Applying a Rate Impact Framework to Multifamily Housing Electrification

As utilities and regulators find new ways to support the energy transition, understanding how EV infrastructure investments impact rates and reliability is essential. To provide that insight, we applied a Rate Impact Framework tailored to the Ontario context, quantifying the utility and ratepayer impacts of proactive, EV Ready retrofits in multifamily buildings. At the core of this analysis is a practical question:

What happens when we scale smart, managed charging, and what does that mean for utility costs and rates?

We modeled two contrasting deployment pathways:

- Uncoordinated Expansion: A status quo approach where individual residents install EV chargers independently or rely on public charging infrastructure. While some home charging is managed, a significant portion of this load cannot be controlled to avoid system peaks, exacerbating grid strain.

- Comprehensive EV Ready Futureproofing: Utilities or governments offer a $600 per-stall incentive for 100% EV Ready retrofits. All eligible multifamily buildings implement futureproofing upgrades. With EVEMS in place, charging is load-shared at the building level and responsive to utility demand signals, enabling strategic load shifting and demand response.

Our analysis followed three steps:

- Step 1: Estimate Load Impacts: We projected the incremental annual energy consumption and coincident peak demand associated with each scenario. While energy use was similar, the peak load contribution in the uncoordinated scenario was substantially higher due to uncontrolled, coincident evening charging.

- Step 2: Quantify System Costs and Revenues: We estimated the incremental grid costs — including generation, transmission, and distribution — alongside additional utility revenues from increased electricity sales. These were benchmarked against Ontario system values, with customizable parameters.

- Step 3: Assess Net Ratepayer Impact: We calculated the net utility benefit under each scenario by comparing costs and benefits. While requiring an upfront incentive, the futureproofed pathway showed a superior return, with lower per-kWh rates due to improved system utilization and peak avoidance.

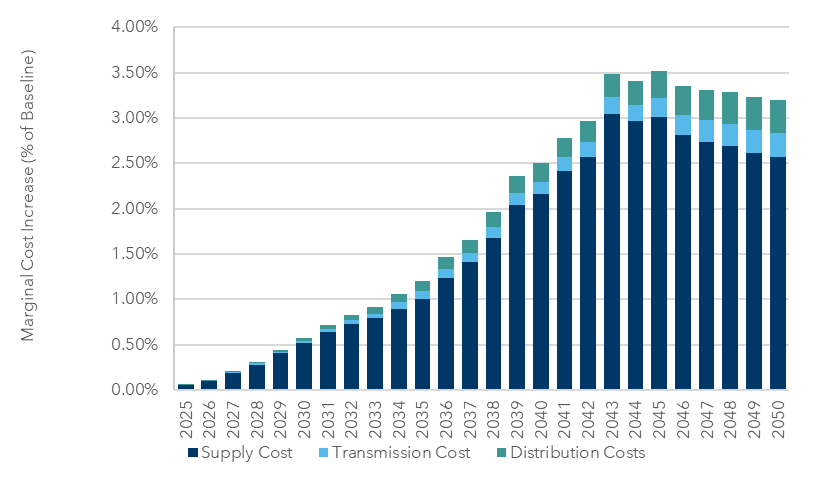

Figure 3: Rate Impact Framework

The model is intentionally high-level, designed to inform utility planners, policymakers, and program designers. Its assumptions can be adapted to reflect regional utility costs or specific program designs, and it serves as a foundational tool to assess whether ratepayer-funded multifamily housing incentives are economically justified.

What the Numbers Tell Us: Coordinated Planning Pays Off

Our analysis confirms that comprehensive EV Ready retrofits deliver greater value to the grid and ratepayers than uncoordinated, piecemeal installations.

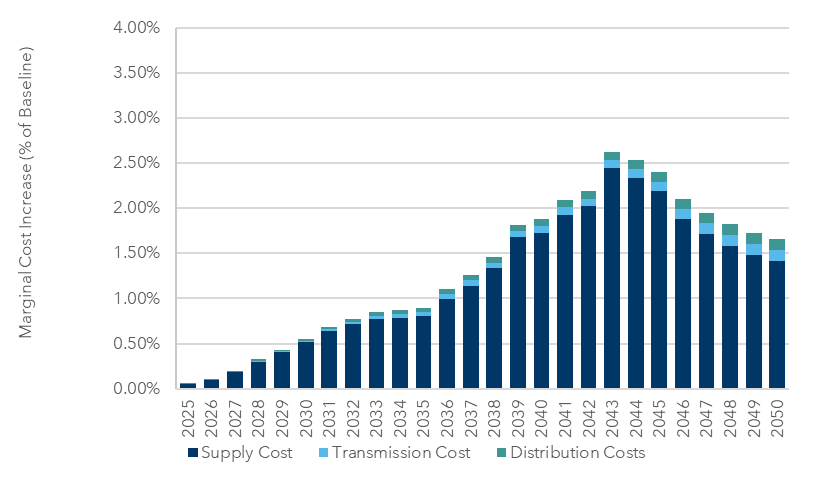

Finding 1: A Comprehensive EV strategy Reduces Marginal System Cost Pressures by ~30%

While both scenarios increase utility system costs over time, particularly for supply, transmission, and distribution, those increases vary sharply. In the Uncoordinated Scenario, unmanaged evening charging drives marginal costs to nearly 3.5% above baseline by the 2040s. In contrast, the Comprehensive EV Ready Scenario, supported by EVEMS-enabled load shifting and strategic planning, holds those increases to around 2.5%.

Uncoordinated Scenario

Comprehensive Scenario

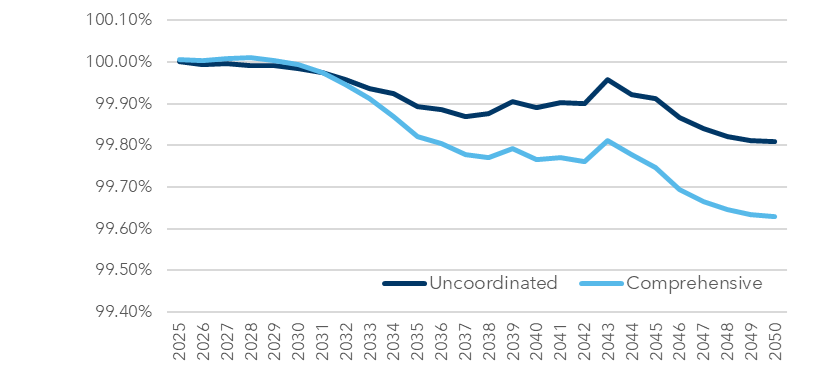

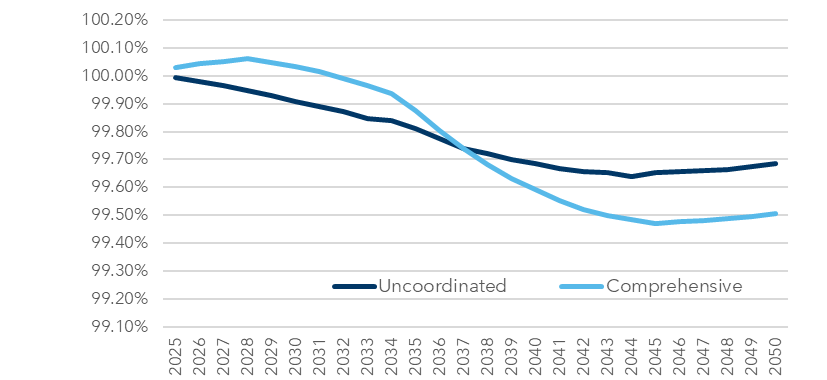

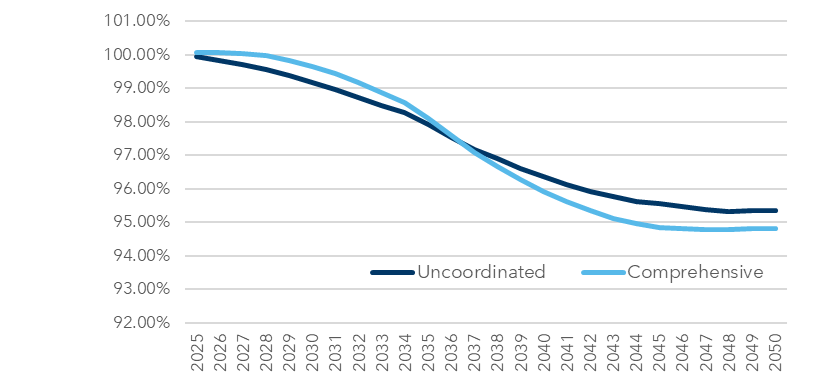

Finding 2: Coordinated EV Readiness Drives Stronger Downward Pressure on Utility Rates

EV adoption results in downward pressure on rates over time, as incremental revenues from increased electricity sales outweigh the associated costs. However, the magnitude of the benefit is consistently higher under the Comprehensive EV Ready Scenario. This is because coordinated infrastructure planning and managed charging lead to lower peak demand growth, reducing the need for costly system upgrades.

Generation Rate Impacts: Under the Comprehensive Scenario, generation rates exhibit a more pronounced and sustained decline over the study period. This is primarily driven by reduced coincident peak demand, which lowers the need for incremental generation capacity. For this analysis, we assume a uniform zonal price across Ontario and that incremental EV charging is billed at the same generation rate as other loads. As a result, both the incremental cost and the revenue benefit are distributed throughout the province.

Transmission Rate Impacts: The transmission rate sees a slight initial increase in the Comprehensive Scenario, as the utility incentives for EV infrastructure are assumed to be funded through transmission rates. However, this is offset over time as managed charging reduces peak system loads and limits the need for upstream transmission capacity investments. The result is a flatter and more favorable transmission rate trajectory than the Uncoordinated Scenario.

Distribution Rate Impacts: Distribution rates decline under both scenarios as the new EV load brings incremental revenue. However, the Comprehensive Scenario consistently shows lower rates over time. This is attributed to avoiding localized distribution system upgrades that unmanaged, resident-led charger installations would otherwise trigger. Coordinated retrofits with EVEMS significantly reduce peak contribution at the building level.

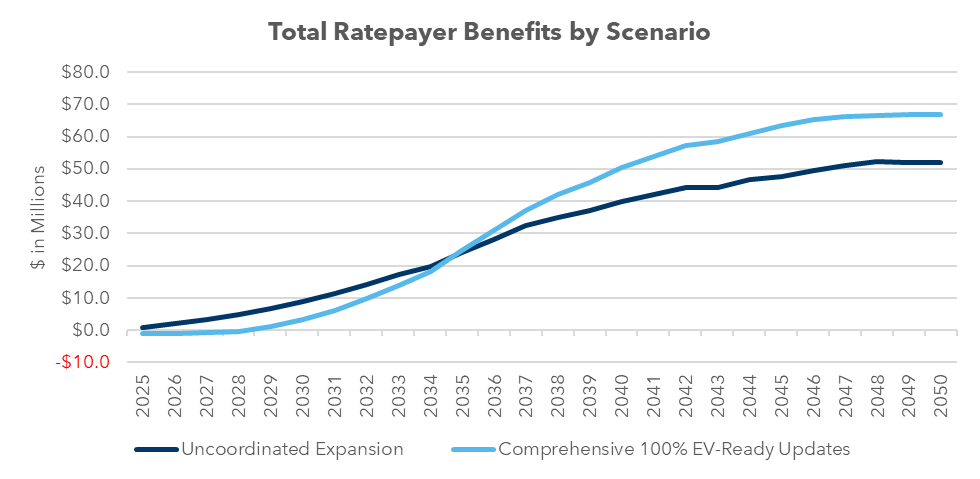

Finding 3: Long-Term Ratepayer Benefits Are Up to 40% Higher Under a Coordinated Strategy

Over the study period, both scenarios yield net benefits to ratepayers, as incremental electricity revenues exceed the costs of serving EV loads. However, the Comprehensive EV Ready Scenario consistently delivers significantly greater cumulative ratepayer benefits, reaching nearly $70 million by 2050, compared to approximately $50 million under the Uncoordinated Scenario for the province of Ontario.

These enhanced benefits are driven by:

- Higher overall EV adoption, enabled by access to convenient, reliable home charging

- Reduced peak demand, lowering the cost of grid capacity investments

- Greater flexibility, allowing utilities to fine-tune system operations through load management

Why Utilities Should Invest in EV-Ready MURBs Now

The path to equitable transportation electrification runs through the parking garages of our multi-unit buildings. As EV adoption accelerates, the stakes of how we equip multifamily buildings are rising. When done reactively, the costs are high, the benefits are uneven, and the grid impacts are significant. However, when done strategically, multifamily housing become one of the most effective — and equitable — platforms for electrification at scale.

The evidence is clear: coordinated EV Ready retrofits don’t just lower costs and improve access for building owners and residents — they generate real, measurable benefits for the entire system. By reducing peak demand, deferring costly upgrades, and aligning charging with grid needs, future-proofed infrastructure can unlock up to 40% greater ratepayer value over the long term.

For policymakers and utilities, the implication is straightforward: supporting comprehensive, managed EV deployment in multifamily housing is not only defensible but also prudent. Incentives for EV Ready infrastructure, especially those that prioritize underserved buildings, can drive faster adoption, stabilize rates, and prepare the grid for what’s next.

EV charging is just the beginning. The systems we establish today — from smart panels to shared circuits — lay the groundwork for tomorrow’s fully electrified buildings, where vehicles, appliances, and heating systems all operate in sync with a cleaner, more resilient grid.

[1] https://ev.com/news/evs-are-charging-ahead-global-ev-sales-forecast-for-a-30-jump-in-2025

[2] Low Carbon Cities Canada (LC3), Futureproofing Multi-Family Buildings for EV Charging, https://lc3.ca/full-report-futureproofing-multifamily-buildings-ev-charging/ (accessed May 21, 2025).

Related Insights

- Read more about Decarbonization Pathways for Equipment in Canada’s Construction and Agriculture Sectors

Decarbonization Pathways for Equipment in Canada’s Construction and Agriculture Sectors

January 19, 2026

Key Takeaways The Future is (Increasingly) Now Low-carbon technology advancements in the off-road transportation sector are accelerating. Once thought unachievable,…

- Read more about From System Planning to Smart Chargers: Take-aways from our “Next 20” Webinar Series

From System Planning to Smart Chargers: Take-aways from our “Next 20” Webinar Series

June 5, 2025

Dunsky recently concluded its 20th anniversary webinar series “The Next 20” which explored the key technology, policy and market developments…

- Read more about Electric fleets can’t wait: reforms to help grid match pace of change

Electric fleets can’t wait: reforms to help grid match pace of change

April 24, 2025

Canada’s electricity sector requires reform if it is to meet growing demand from transportation electrification, particularly from medium- and heavy-duty…