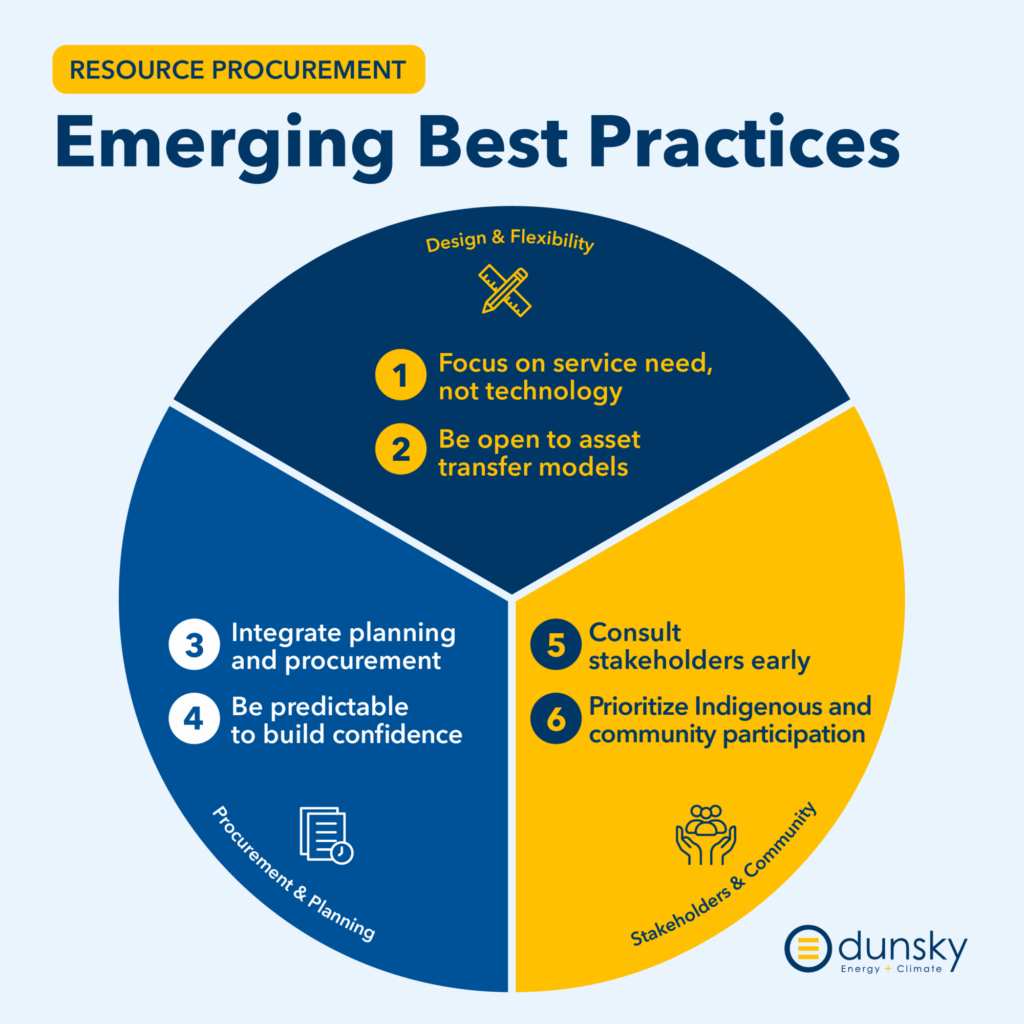

Emerging Best Practices for Resource Procurement

With electricity demand surging and infrastructure aging, utilities face pressure to procure new generation quickly, cost-effectively and reliably.

Around the world, governments, regulators and utilities are rethinking procurement frameworks to accelerate timelines, improve flexibility and unlock new resource options. Our recent review of leading international jurisdictions in Canada, the U.S., Europe and Oceania reveal six key takeaways around the innovative procurement practices that are helping utilities rise to the challenge.

Breakdown of Best Practices

Design & Flexibility:

Focus on the service need, not the technology: When well-designed, a resource-neutral approach fosters competition, helping utilities reduce costs and improve flexibility. Hybrid projects and separating tenders by service (e.g.:, capacity vs. energy) can further boost participation, fairness, and improve overall results.

One example of this approach is the Independent Electricity System Operator’s (IESO) Long-Term 2 (LT2) procurement. IESO issued separate RFPs for capacity and for energy services, which helps ensure each market segment competes on a level playing field, allowing resources to be evaluated on the specific service they can deliver. It also encourages developers of hybrid projects to participate in one or both streams.

BC Hydro’s 2025 RFEOI for Capacity is another good example of a technology-neutral approach that is nonetheless service-specific. BC Hydro is targeting dispatchable capacity during winter peak periods, while also creating a procurement pathway for early-stage resources with unique procurement needs and capable of delivering additional grid services beyond capacity (e.g.: voltage support or frequency control). Without such tailored requirements, these resources might struggle to participate fairly in a standard technology-neutral approach.

Be open to asset transfer models: Some regulated utilities issue tenders that allow bidders to propose an asset transfer model at the end of construction. By taking ownership of the assets from developers, utilities can reduce project development risks, gain long-term flexibility and control, and benefit from capital efficiency and extended depreciation horizons. However, such arrangements should be carefully assessed, weighing their financial implications against strategic objectives.

Procurement & Planning:

Integrate planning and procurement: Develop RFPs at the same time as the Integrated Resource Plan (IRP) to streamline regulatory approvals and ensure that procurement decisions are firmly anchored in long-term system needs. In Colorado, the IRP process is tightly linked with procurement, where the outcomes of the IRP are already approved by the regulator and directly translated into concrete RFP requirements and evaluation criteria in subsequent market solicitations.

Be predictable to build confidence: Communicate clear timelines, stable rules and procedures, as well as transparency about future opportunities to foster proponent trust and help improve project outcomes. For example, Australia’s revenue-underwriting Capacity Investment Scheme (CIS), which expanded in 2023, runs separate tenders for renewable generation and clean dispatchable capacity, with a published schedule by market (generation vs dispatchable). This happens at a predictable cadence of approximately every six months for the National Electricity Market and annually for the Western Australian Wholesale Electricity Market until 2027.

Stakeholders & Community:

Consult stakeholders early: Shape procurements with upfront input from potential proponents, technology vendors and other stakeholders to reflect evolving market dynamics, risks, and to boost project viability and participation. In Ontario’s latest LT2 procurement, the IESO engaged stakeholders a year before the final release of the RFP and throughout the process, publishing comments and responses after each session to ensure transparency. This approach effectively captured market perspectives and informed procurement design adjustments.

Prioritize Indigenous and community participation: Embed community benefits into procurement through features such as mandatory equity participation or incentivized scoring to support equity, trust and social acceptance. In Canada, several utilities have established minimum Indigenous community equity participation requirements. For example, BC Hydro sets its requirement at 25%, while SaskPower sets it between 10–30%, and Manitoba Hydro sets it at 51%. In Germany, the Renewable Energies Act (EEG) requires solar and wind developers to offer nearby municipalities a financial participation of up to €0.002 per kWh, enhancing social acceptance and driving local economic benefits.

Contact Us

If you’re navigating the complexities of electricity procurement, we can help. Our team brings deep expertise in:

📌 Procurement advisory services

📌 Technology assessments

📌 Price discovery & benchmarking

📌 Industry engagement

📌 Bid evaluation support

Contact us at info@dunsky.com.